Numerous organizations, including FASB (USA), ASG (UK), and ASB (Australia), have acknowledged it for the purpose of establishing external reporting and inventory value (India). (d) With the help of absorption rate, manufacturing expenditures that aren’t related to a single product get distributed. This rate could be the factory’s overall recovery rate or departmental recovery rates. Production expenses, administrative costs, selling costs, and distribution costs are all divided into functional categories.

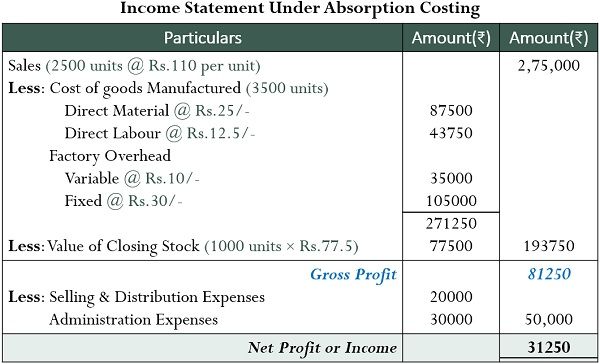

Net Income Determination in Absorption Costing

Most companies use absorption costing for external financial reporting purposes. Full absorption costing–also called absorption costing–is an accounting method that captures all of the costs involved in manufacturing a product. Additionally, when there is unsold inventory, absorption costing can result in higher reported profits because fixed overhead costs are deferred into inventory until the products are sold.

How do you calculate absorption rate in management accounting?

- Calculating absorbed costs is part of a broader accounting approach called absorption costing, also referred to as full costing or the full absorption method.

- These materials can be easily traced to a specific product, such as raw materials and components.

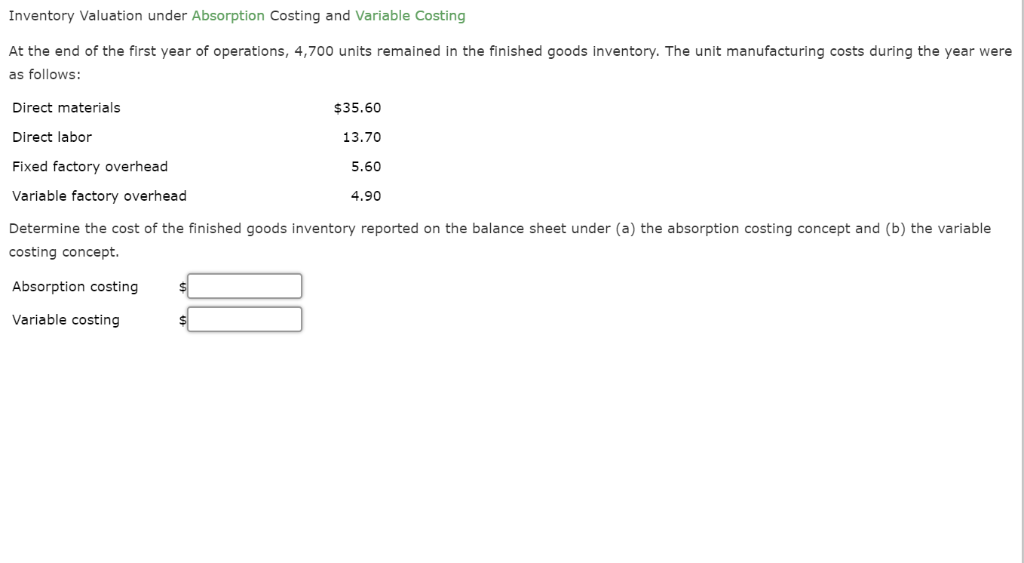

- Absorption costing is an inventory valuation method that allocates all manufacturing costs, including both variable costs and fixed overhead costs, to the units produced.

- Companies using absorption costing must understand these inventory valuation implications for accurate financial statement analysis when production volumes change.

- Variable costing will result in a lower breakeven price per unit using COGS.

- These costs are also known as overhead expenses and include things like utilities, rent, and insurance.

Most companies may have to transition to absorption costing at some point, however, and it can be important to factor this into short-term and long-term decision-making. Because absorption costing includes fixed overhead costs in the cost of its products, it is unfavorable compared with variable costing when management is making internal incremental pricing decisions. This is because variable costing will only include the extra costs of producing the next incremental unit of a product.

Absorption Costing vs. Variable Costing: An Accounting Perspective

This means the company would allocate $10 of overhead to each unit produced. Once you complete the allocation of these costs, you will know where to put these costs in the Income Statements. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. If, however, it falls short of the actual overhead, the difference is known as under-applied overhead. This is one of the oldest methods of cost absorption and it is widely regarded as one of the best.

4 Full absorption costing

(a) The finished product absorbs all manufacturing costs, whether direct or indirect. Period costs include all overheads related to the organization, sales, and distribution. As a result, profits get subtracted from the time in which they take place. Companies using the cash method may not have to recognize some of their expenses immediately with variable costing because they’re not tied to revenue recognition.

So in summary, absorption costing income statements allocate all manufacturing costs (variable and fixed) to inventory produced. This results in fixed costs impacting COGS rather than flowing straight to the income statement. In summary, absorption costing provides a full assessment of production costs for inventory valuation, while variable costing aims to show contribution margin and provide internal reporting.

Operating expenses are represented on the income statement in the same way under absorption and variable costing. Both fixed and variable operating expenses incurred during the period are recorded. The overhead absorption rate is an important concept in management accounting. It helps operating leverage formula: 4 calculation methods w video companies determine the full cost of producing a product or service. This differs from variable costing, which only allocates variable costs to units and treats fixed costs as period expenses. Total machine hours are used to determine the overhead absorption rate in this method.

Absorption costing captures all manufacturing costs, including direct materials, direct labor, and both variable and fixed overhead, in the valuation of inventory. Absorption costing is linking all production costs to the cost unit to calculate a full cost per unit of inventories. This costing method treats all production costs as costs of the product regardless of fixed cost or variance cost. It is sometimes called the full costing method because it includes all costs to get a cost unit.